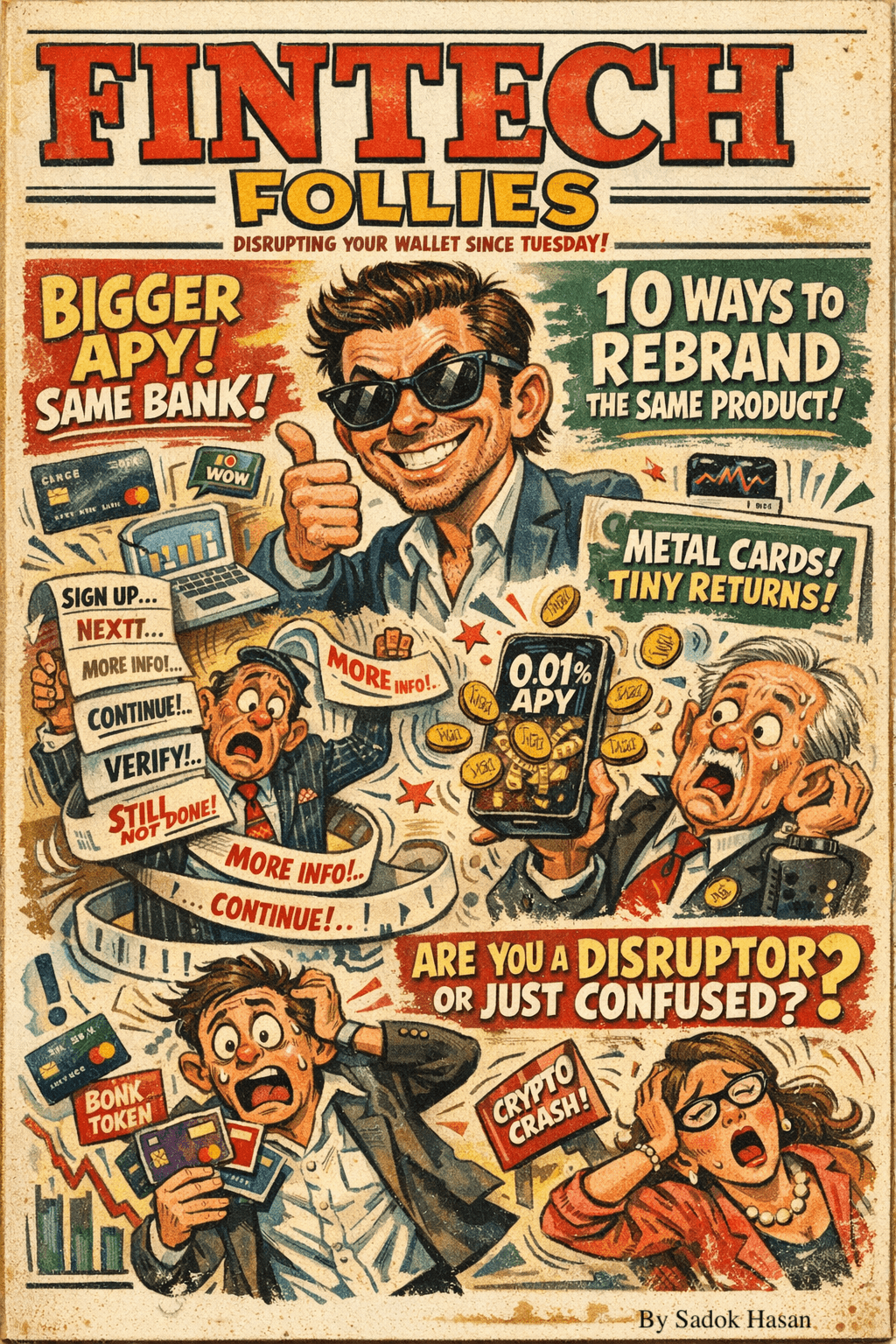

The Golden Age of Fintech Is No More.

Jan 28, 2026

The so-called “golden age” of fintech growth is probably behind us. What we are entering instead is an attention-constrained market.

For a long time, fintech scaled on utility. Better UI, marginally higher yield, faster payouts, or premium cards were enough to win share.

That advantage has largely commoditized.

Today, most fintech products are functionally interchangeable. Switching costs are close to zero, and feature differentiation is short-lived.

The problem is that fintech marketing has not adapted.

Most advertising is still trapped in a feature-benefit loop. Manage spend. Get paid early. Invest seamlessly. Customers have seen these messages hundreds of times. They are not scrolling LinkedIn looking for another spreadsheet. They are looking for perspective.

The companies breaking through right now are not selling lower fees.

They are selling a point of view.

Three shifts stand out.

First, clarity beats neutrality. Brands that try to appeal to everyone tend to disappear. Clear positioning creates contrast, even if it introduces discomfort.

Second, education outperforms persuasion. Finance is stressful and abstract. Ads that teach something small but useful earn attention before they ever ask for conversion.

Third, authority must be contextual. Generic “join now” messaging underperforms. The strongest fintech ads increasingly resemble insight reports, using real data and informed interpretation to say something meaningful about the world.

In a market where products are easy to copy, brand becomes the only durable moat.

Fintech is no longer just about moving money efficiently. It is about making customers feel informed, confident, and ahead of the curve.

The open question is simple.

Are you still selling features, or are you building trust through perspective?